27 June 2025, Manila — Despite the nationwide decline in inflation, prices of various goods continue to rise in sari-sari stores across the Philippines.

This is according to new data from Filipino tech startup Packworks, which analyzed more than one million monthly sales transactions from its network of over 300,000 sari-sari stores nationwide through its mobile app and business intelligence tool, Sari IQ. The study tracked price movements from 2023 to 2025 and found that costs continue to climb despite a general decline in inflation.

Based on its research, overall stock-keeping units (SKUs) in sari-sari stores have been subject to frequent fluctuations in prices during the two-year period, covering multiple product categories such as food, personal care, and other common goods available in the general trade, with averages of at least 11% price increases dependent on specific areas nationwide.

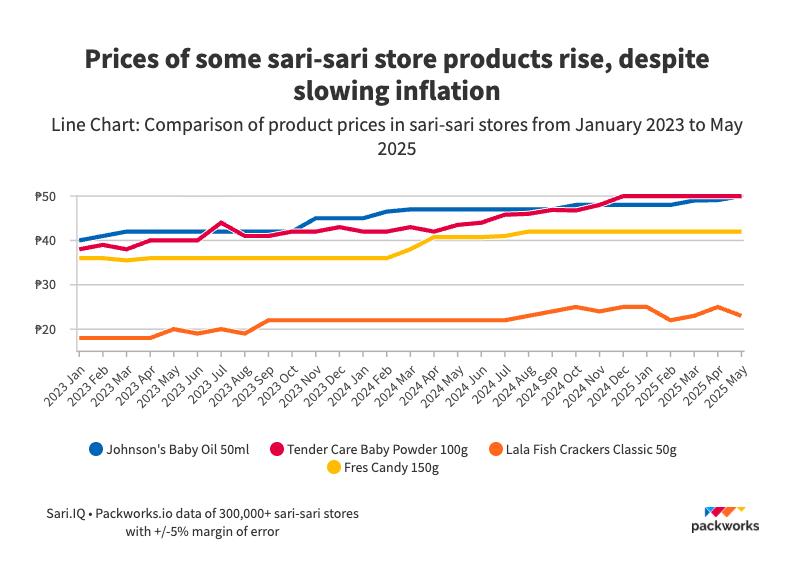

Some highlights include normally stable items, such as baby oil and baby powder, which recorded retail price increases across the board. Notably, a 50-milliliter (ml) bottle of Johnson’s regular baby oil increased by 17%, from PHP 42.00 in 2023 to PHP 49.00 in 2025. Meanwhile, a 100-gram pack of Tender Care baby powder rose by 25%, from PHP 40.00 to PHP 50.00. These price hikes were observed in at least five regions: Ilocos Region (Region I), Cagayan Valley (Region II), Central Luzon (Region III), MIMAROPA (Region IV-B), and Bicol Region (Region V).

The study also found that the humble barya-barya sari-sari store candies and snacks were not exempt from these price spikes, where up to 11 different SKUs within the confectionery and snacks category experienced at least a 13% increase in retail price. For example, the 50-gram pack of Lala Fish Crackers Classic, a popular and usually affordable sari-sari store snack, saw its price surge by 27%, rising from PHP 18.00 in 2023 to PHP 23.00 today. These spikes were recorded in stores based in Regions II and IV-B.

Another popular item, the 150-gram pack of Fres candy, recorded a 16% price increase across all its variants, now at PHP 42.00, up from PHP 36.00 two years ago. The candy brand is now more expensive in at least nine regions, including Ilocos Region (I), Cagayan Valley (II), Central Luzon (III), MIMAROPA (IV-B), Bicol Region (V), Western Visayas (VI), Central Visayas (VII), and Eastern Visayas (VIII).

Packworks Chief Data Officer Andoy Montiel highlights the vulnerability of sari-sari stores, saying even a slight increase in their wholesale purchase price can invariably affect end consumer pricing.

“Sari-sari stores are known for their thin profit margins. While they operate as viable businesses, they also serve as extended pantries and community hubs for their neighbors. Even a slight increase in wholesale prices reveals how vulnerable micro-retailers are to cost shifts upstream. This creates a ripple effect, especially in low-income communities where these stores are the primary source of daily essentials,” Montiel said.

The upward price trend stands in contrast to the declining national inflation rate. In 2023, the country’s Year-on-Year (YoY) inflation rate was 6.0%, then significantly dropped to 3.2% the following year. It decreased further to 1.9% from January to May 2025, hitting a low of 1.3%, the lowest since November 2019.

Packworks’ data also focused attention on pricing trends with the country’s main staple commodity — rice. A five-kilogram pack of premium rice rose from PHP 235.00 (PHP 47.00/kg) in 2023 to PHP 295.00 (PHP 59.00/kg) in 2024, reflecting a PHP 60 increase. This aligned with the Philippine Statistics Authority (PSA) and Department of Agriculture (DA) reports, which cited rice inflation and retail prices ranging from PHP 50 to PHP 58 per kilo during the period.

From January to May 2025, the price slightly dropped by 3.39% to PHP 285.00 (PHP 58.00/kg), following the DA’s imposition of a maximum suggested retail price (MSRP) on imported rice. However, it remains higher than the national average of PHP 50.54 per kilo for well-milled rice. The data also noted similar price variations in the repacked rice or tingi-tingi bigas bundles that are usually informal SKUs but are frequently sold in sari-sari stores at smaller increments to make purchases more affordable or abot-kaya for its neighborhood customers.

Packworks Chief Executive Officer Bing Tan emphasizes the importance of helping sari-sari stores thrive amidst economic shifts.

“Sari-sari stores are more than just retail outlets, but a lifeline for millions of Filipinos. Our latest analysis reveals some gaps between national macroeconomic reports and the grassroots micro-retail reality; these insights can act as early indicators to inform distribution chains and policymakers of where support and aid are most needed. It is our hope that by sharing this timely data, we will be able to shed a brighter light on the challenges in practical pricing our store owners face in serving their communities.”

Sari-sari stores serve as the primary source of daily essentials for around 94% of Filipinos.